AFC Wimbledon & The Dons Trust

As part of the Dons Trust Board’s commitment to open and transparent communication with members, we are pleased to provide this financial review of AFC Wimbledon in June 2021. It includes a financial summary of 2020-21 and a look ahead to 2021-22 and future years.

The most critical challenge facing the club and Trust is to refinance the £4.6m bridging loan by spring 2022.

2020/2021 review: This season has been marked by two significant events. First, COVID has meant games were played without supporters. Secondly, we saw the miraculous return of our club to Plough Lane. The stadium is, at time of writing, complete apart from the East Wall still under construction and some aspects of fit-out.

Through COVID, all football clubs across the country have struggled, with many running at a significant loss and relying on the generosity of their supporters and/or owners. Our football club is no different, and we expect to record an operating loss for the year of approximately £0.6m. We would have been in a very much worse position without the incredible generosity of our members and supporters.

Financial position summary: In the next 12 months we need to repay the £4.6m short-term bridging loan (secured against the stadium). Member contributions will again be a critical factor in that repayment and refinancing. To that end, the Club has recently launched a new 25-year season ticket, sitting alongside Debenture, Season Ticket and Plough Lane Bond options for members and supporters. We must refinance this £4.6m before April 2022 to maintain and protect our ownership model.

The future: This will be our first season operating fully at Plough Lane, as we look forward to welcoming supporters. There are still unknowns affecting our financial planning process, but subject to there being no more disruption from COVID, we are aiming to at least break even in the next financial year, before interest payments.

Our long-term financial strategy is to ensure AFC Wimbledon is a sustainable, fan-owned club. Breaking even is an important step toward the Club generating profits that will help fund future growth on and off the pitch, without always having to rely on members. We are putting in place a new five-year business plan to grow and diversify revenues to achieve this.

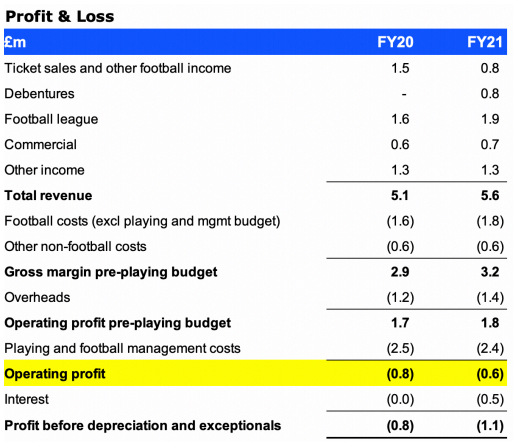

2020/21 financial performance

Overview

We expect an operating loss of approximately £0.6m for this season.

This includes debenture sales (although they are 10-year commitments and may be treated differently in the audited accounts), but excludes interest (mainly on the MSP loan).

Whilst this is a creditable result for a season with no crowds in the stadium, it still represents a significant cash loss and is likely to leave low cash reserves for the next season.

This year’s loss has been mitigated through the commitment of both our supporters and corporate partners.

The sale of non-refundable season tickets, iFollow passes and debentures have provided a lifeline to the football club in the midst of the pandemic.

Our corporate sponsors paid for the sponsorship packages up front, despite the uncertainty surrounding this season, providing valuable funds when they were most needed.

A massive thank you to fans for their financial support through non-refundable season tickets and debentures, and to our sponsors for their ongoing support throughout the pandemic and its effects.

Income

- Ticket sales (£0.8m): mostly non-refundable season tickets, also includes prize money and transfer fees.

- Debentures (£0.8m): shown as income in 2020/21, although they may be spread over 10 years in the statutory accounts.

- Football league funding (£1.9m): including the additional grant paid by the Premier League to EFL clubs.

- Commercial revenues (£0.7m): corporate sponsorships plus iFollow (approx. £0.2m this season).

- Other income (£1.3m): Academy income, merchandise, events and donations.

Expenditure

- Football costs excl playing budget (£1.8m): relate to all day to day football club costs plus academy costs, training ground and pitch maintenance.

- Other non-football costs (£0.6m): merchandise, commercial and other costs.

- Overheads (£1.4m): staff costs (non-football staff) and other operating costs (utilities, office costs, IT, services).

- Playing and management wages (£2.4m): covers all player and football management wages.

Our loss of income owing to COVID was offset by EFL funding and our fan and sponsor generosity. Our playing budget placed us 21st in the League One budget table according to EFL figures.

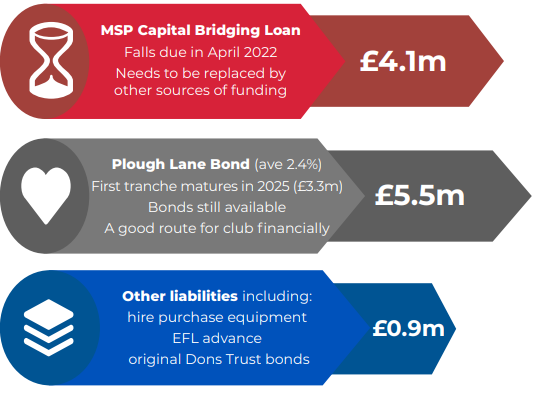

Finance committee’s summary of our funding position

The biggest challenge facing our club in the immediate future is refinancing its external debt, especially the bridging loan.

Alongside the Plough Lane Bond, the Seedrs crowdfunding campaign and individual investments by Nick Robertson and others, the £4.1m bridging loan from MSP Capital was also needed to complete the construction of Plough Lane at a total cost of £33m.

This refinancing challenge has been exacerbated by the impact of Government restrictions in response to COVID.

This resulted in the 2020-21 loss and has also delayed the start of our operations at Plough Lane – so we don’t yet have a track record of revenue streams at the new stadium which would help us borrow from banks.

Refinancing this bridging loan is our biggest and most important priority. This debt is secured against the stadium and the interest cost is relatively high, as is typical for short term bridging loans.

We are therefore exploring all avenues of refinancing, but we need help from our members (the club’s owners), as detailed below.

Debt due in 2022: The club must refinance £4.6m in total – our biggest immediate concern. There are possibilities for growth once Plough Lane is fully operational, but investment is needed to unlock this.

Routes to refinance

Investment required

In order to assist in refinancing the bridging loan, we need further support from members, fans, commercial partners and sponsors.

Coinciding with the season ticket renewal window and in advance of the debt falling due, the club has launched the 25-year season ticket scheme.

These 25-year season tickets, alongside Bonds and debentures, are crucial in paying down some or all of the MSP Capital loan and protecting the club’s ownership model.

The aim of our football club is to be financially sustainable.

Once the MSP debt is repaid, the club will have a solid financial foundation upon which to build for the future at Plough Lane.

Plough Lane Bonds, debentures and now 25-year season tickets are all key to our financial management and stability.

It is vital therefore that we promote all avenues of supporting and investing in the club.

25-year season tickets will massively assist in refinancing bridging loan debt in 2022. Plough Lane Bonds and debentures will also help the club financially.

2021/22 financial year

We are budgeting for a breakeven season (before interest) for 2021/22. To do this we have assumed:

- Home and away fans are able to attend matches without COVID restrictions on attendances. We are aiming for an average attendance of 7,500;

- The stadium is fully operational (both in terms of revenues and costs);

- We are able to realise a full range of commercial income, including from our events space and the Broncos groundshare; and

- No player sales or significant cup income (for the purposes of budgeting).

If attendances are restricted for part or all of next season this will have a major impact on our income and our cash.

We can address this to a certain extent by fundraising and by minimising costs, but the bottom line is that our club

(in common with most EFL clubs) cannot sustain itself financially without crowds.

Longer-term outlook

The aim of the football club is to ensure it is financially self-sustaining (i.e. without the need for external funding to

support the club’s normal operations) in the long-term.

This was the financial rationale behind the design of Plough Lane.

We also need to generate operating profits so that we can plan to repay debts and also have a financial cushion against

risks and surprises.

We are working through a five-year business plan that will outline how this can be achieved, building on a break-even

performance in year one, to operating profits in years two-five.

The major sources of the improved financial performance are expected to come from non-football and non-traditional

sources of revenue, making full use of the space and facilities that we have at Plough Lane.

The club is aiming for a break-even year in 2021-22. This assumes we will be welcoming full crowds back to Plough Lane.

Help us meet our challenges

The generosity of our fans, sponsors and supporters have cushioned our club better than many others from the impacts of COVID.

But we re-iterate that the most critical challenge facing our club is to refinance the £4.6m bridging loan by spring 2022.

The club has launched 25-year season tickets to address this need. For those fans with savings or disposable income, these represent a fantastic way to help the club secure its financial future while providing a great return for the ticket holders over the next 25 years.

They can be invested, transferred or gifted.

Further information is available from the club website https://www.afcwimbledon.co.uk/tickets/25-years-season-tickets/ by calling 020 3988 7863 or emailing tickets@afcwimbledon.ltd.uk.

We appreciate that these are a major financial commitment for members. But there are other ways to assist the club as we look to

grow in our new home and recover from the impact of the COVID pandemic. These include:

-

- Financial investment: Plough Lane Bonds remain open.

- Helping to increase matchday attendance: Once crowds are allowed at matches, the club’s financial position improves in direct correlation to average attendance. So the more fans who come to matches and who help grow the gate by bringing friends and family to enjoy seeing Wimbledon back at Plough Lane, the better. Let’s all work to fill Plough Lane as much as possible. As a wise man once said, we just want to watch football.

- Helping to increase matchday and non-matchday revenues: The more money the club bars, food outlets, hospitality etc make on a matchday the better. And of course the same is true now for the new non-matchday commercial opportunities for the big event space and further hospitality spaces. And there is no greater advertising than personal recommendation or word of mouth, so we invite all members to take advantage of what the club has to offer at the new stadium and to encourage others to do so.

As part of our priorities for 2021-22 we have made some changes to governance. These are outlined in the second part of this

document. The club and Trust are also still open to discussions with further minority investors looking for a shareholding in AFC

Wimbledon plc using the equity made available before the Seedrs crowd raise, which keeps Dons Trust ownership at 75% of the

voting shares. We would also like to thank the finance committee for all their work and support since being set up in 2020.

Next season promises to be tremendously exciting as we welcome crowds to Plough Lane for the first time and can celebrate the

stadium that our members and fans have made possible. We look forward to enjoying watching Mark Robinson’s team take on our

sixth season in League One and working together to secure the club’s financial future as we rebound from the effects of COVID and

grow in our new home.

Xavier Wiggins and Jane Lonsdale, DT Co-Chairs

Joe Palmer, CEO, AFC Wimbledon